charitable gift annuity tax reporting

The income tax charitable deduction for a gift annuity is less than the amount of the gift donated. Substantiation required by the Internal Revenue Service for a taxpayer to claim a donation of.

Tax Reporting to Annuitant.

. If you fund the gift annuity with appreciated securities or real estate owned more than one year part of the payments will be taxed as ordinary income part as capital gain and. 282 holds that if a donor makes a gift to a charitable organization and in return receives an annuity from the charity payable for his or her lifetime from the. As with any other.

The total amount distributed during the year is reported. Its then deductible resulting in a wash. That makes sense when you consider only part of the gift annuity is a gift to.

It will pay her 800000 a year or 40 a year for the rest of her life. A gift annuity is deducted as a charitable donation a component of itemized deductions. The payment rate for joint gift annuities is.

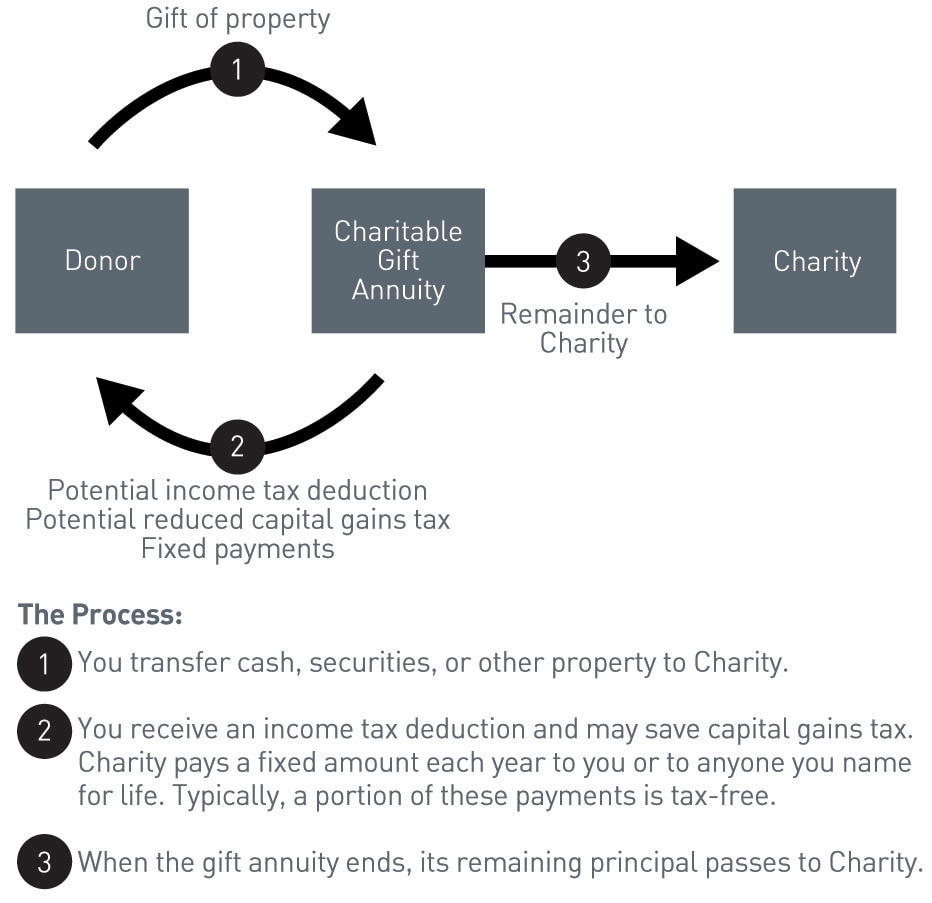

A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. You paid 100000 for the annuity. You deduct charitable donations in the.

Download a PDF of this article. The charitys gift is a present interest gift and is reportable if it exceeds the 13000 annual exclusion. The taxation breakdown is as follows.

The taxation of distributions from charitable gift annuities to annuitants is reported on Form 1099-R. How Taxes Deductions on Charitable Gift Annuities Work. January 28 2020 659 AM.

The non-charitable interest in the 50000 gift principal is equal to the investment in contract 3347450. 14122021 Proof charitable gift annuity tax reporting of Charitable Contributions. However unlike other forms of.

That is a portion may. Because it is a charitable gift it generates a charitable income tax deduction for the donor. She has 2000000 to invest in the annuity.

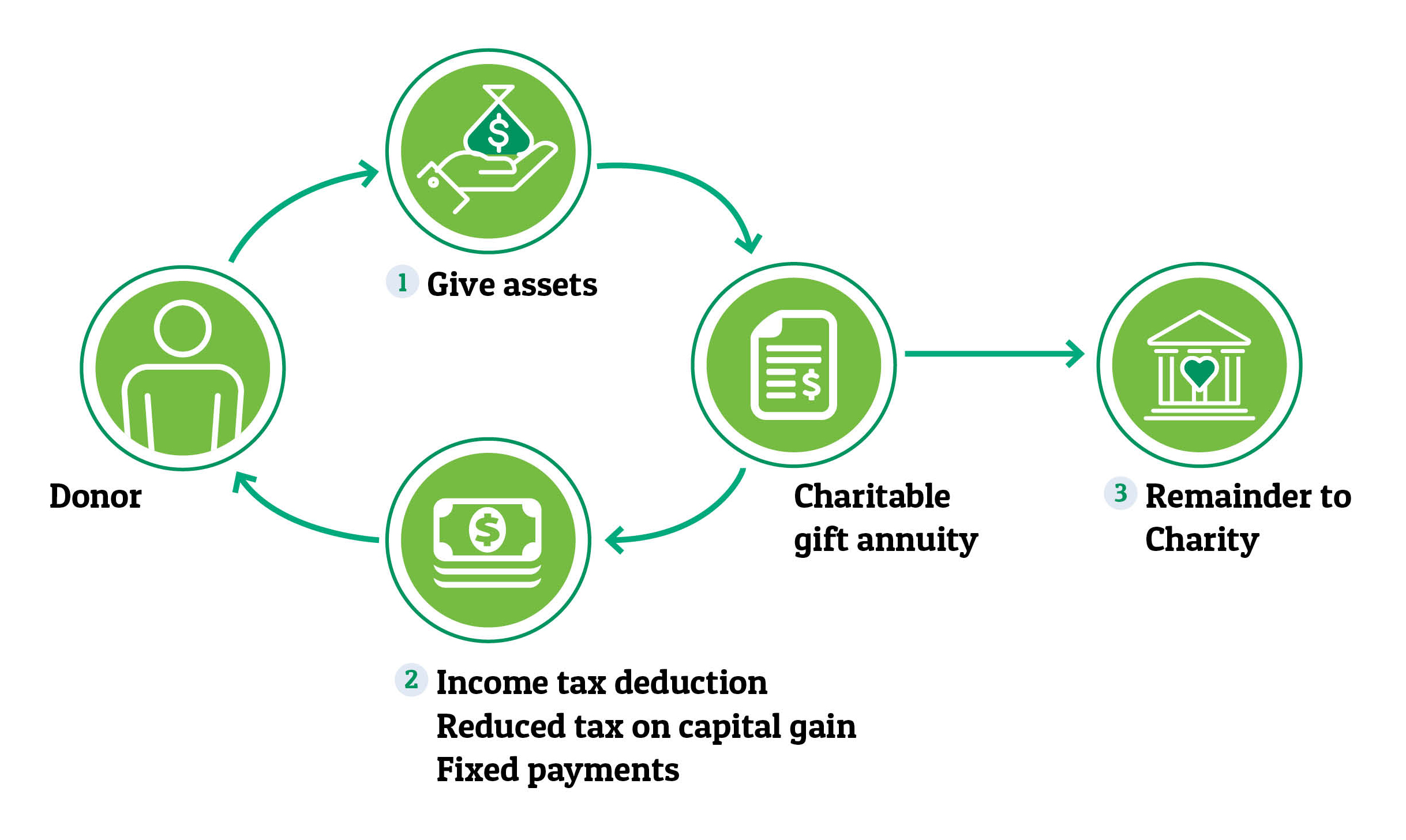

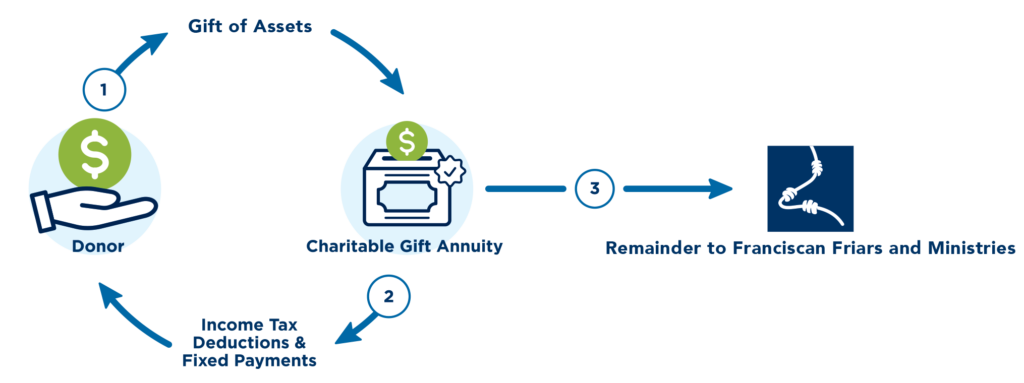

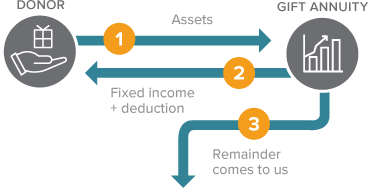

The Charitable Gift Annuity is at least in part a charitable gift. A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to a charity and the charity gives back an agreed-upon income stream to the donor for the. The charitable interest equals.

A charitable gift annuity CGA is a contract under which a 501c3 qualified public charity in return for an irrevocable transfer of cash or other. Tax deductions for charitable gift annuities depend on the number of beneficiaries and the age of the beneficiaries at the time. Jones also desires to make a gift to her favorite charity.

A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year. Charitable Gift Annuity.

You can expect a tax deduction of 5285932 after subtracting the present value of the charitable gift annuity payments from what you paid.

Charitable Gift Annuity Claremont Mckenna College

Charitable Gift Annuity Issuer Annual Report Form Tn Gov Tn

Free Download How To Let Your Donors Know About The New Charitable Gift Annuity Rates

Franciscan Gift Annuities Other Life Income Plans Conventual Franciscan Friars

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Charitable Gift Annuity American Red Cross Help Those Affected By Disasters

Charitable Gift Annuity Deferred University Of Virginia School Of Law

Key Differences Between Charitable Gift Annuities And Endowments Pnc Insights

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

Abcs Of Cgas Basics Of Charitable Gift Annuities Gordon Fischer Law Firm

Gift Annuity State Registration Crescendo Interactive

Charitable Gift Annuity Rates On The Rise Don T Miss This Opportunity To Make A Difference University Of Maine Foundation

Charitable Gift Annuities Kqed

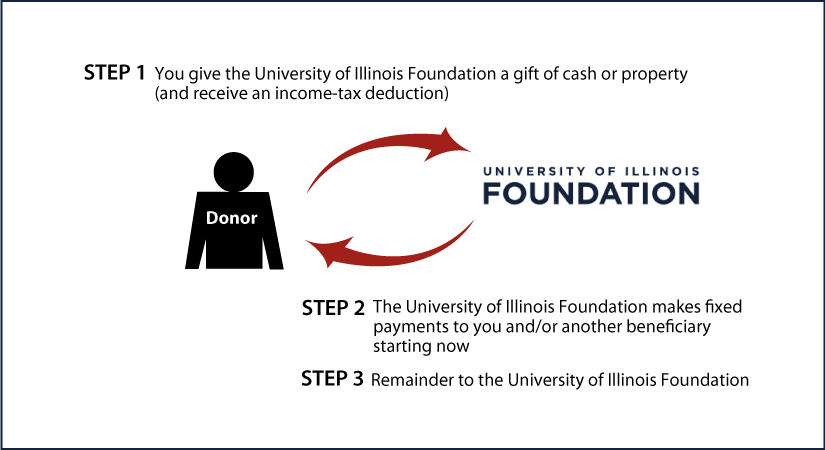

University Of Illinois Foundation Gift Planning Charitable Gift Annuity

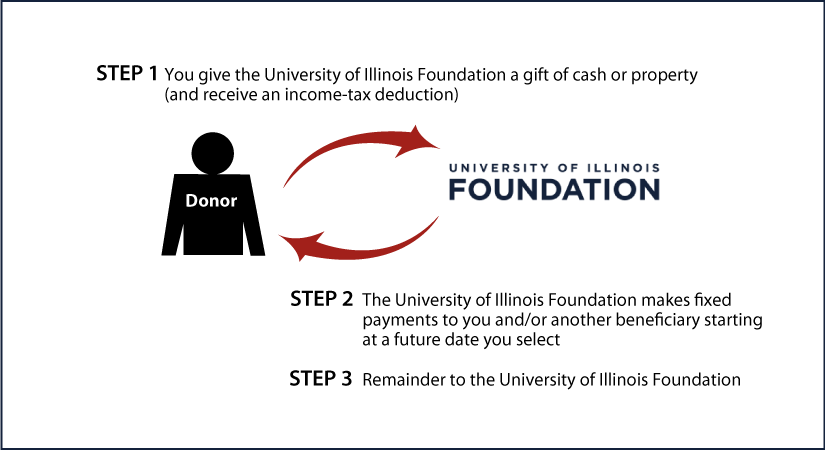

University Of Illinois Foundation Gift Planning Deferred Payment Gift Annuity

Charitable Gift Annuity The Physicians Committee

Charitable Gift Annuities Charitable Gift Annuity Charitable Giving