san francisco gross receipts tax due date 2022

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. Estimated business tax payments are due April 30th July 31st and October 31st.

What Are Key Tax Deadlines For Startups Pilot Blog

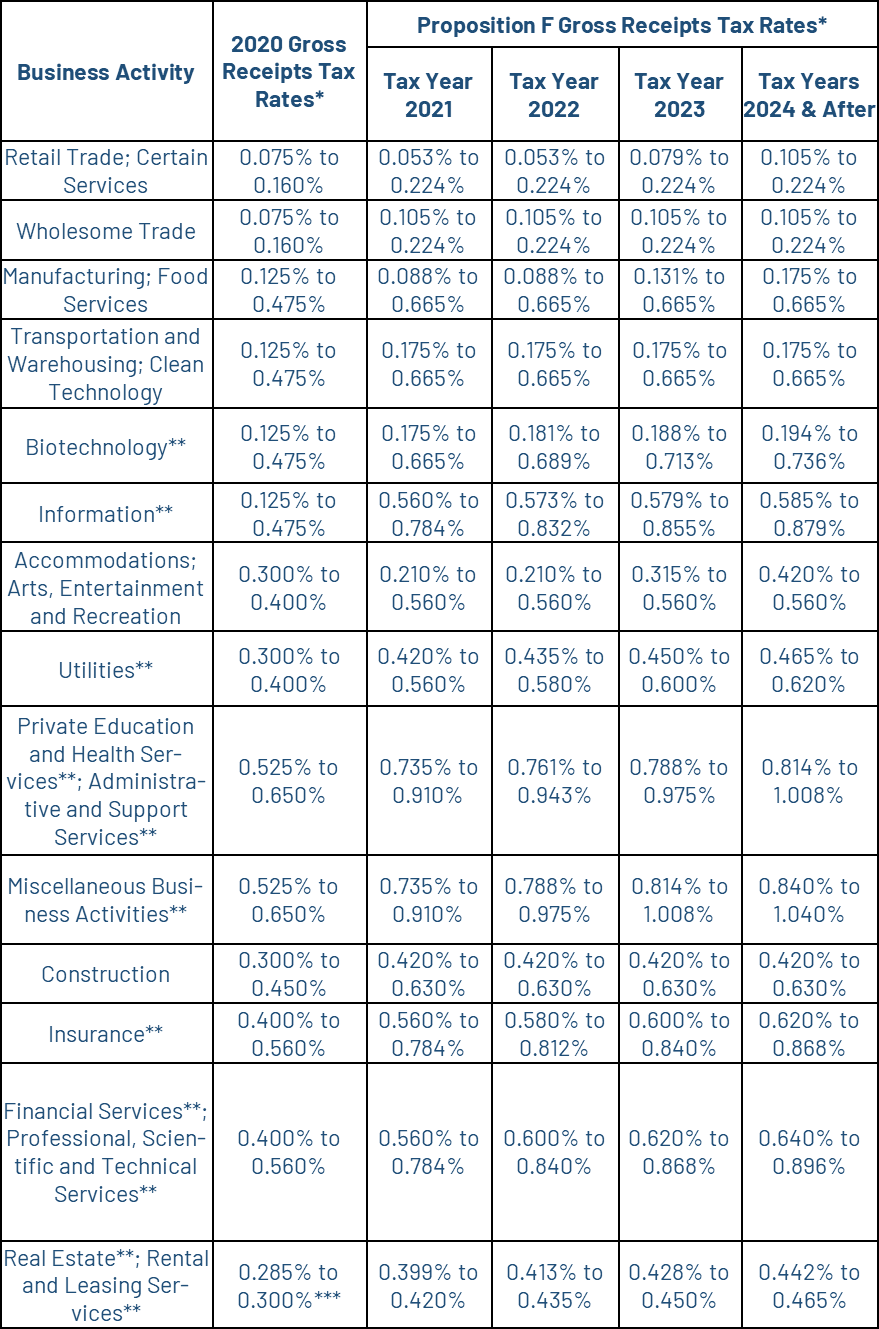

In 2014 the Office of the Treasurer and Tax Collector began implementing the Gross Receipts Tax and Business Registration Fees Ordinance.

. Who is subject to San Francisco gross receipts tax. The 2017 gross receipts tax and payroll expense tax return is due. The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or.

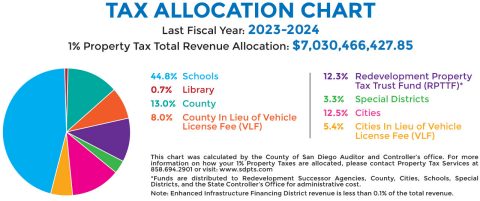

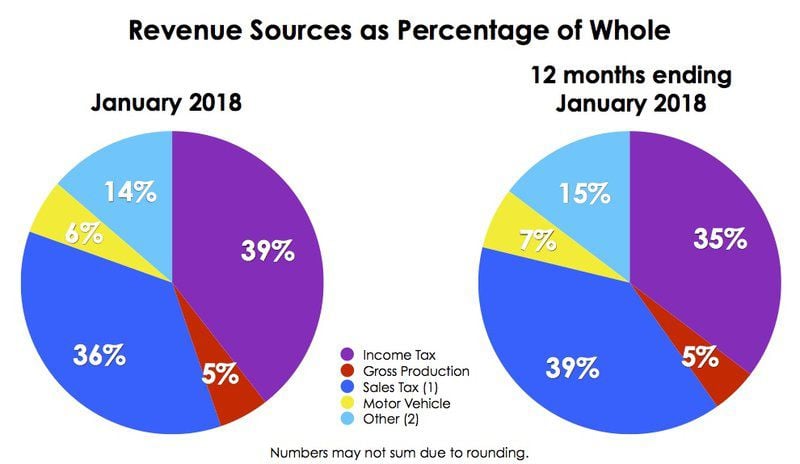

Payroll Expense Tax. The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes. Additionally businesses may be subject to up to four local san francisco taxes.

In 2022 San Francisco has many unique corporate tax deadlines beyond. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. The three taxes are the San Francisco Gross Receipts Tax the Homelessness Gross Receipts Tax and the Commercial Rents Tax.

Due to COVID-19 the San Francisco Board of Supervisors has changed the due dates of certain business taxes and license fees. The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively. Down from 0829 for tax year 2016.

The city of San Francisco levies a gross receipts tax on the. Which was approved by voters in November. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

Lean more on how to submit these installments online to comply with the Citys business and tax regulation. Tax Collectors Office 915 Deadline to file a formal appeal of your 20222023 assessed Business Personal. An extension can be filed by February 28 2018 to extend the filing due date to May 1.

You dont have to miss a deadline. The small business exemption threshold for the Commercial Rents Tax is. In 2022 san francisco has many unique corporate tax deadlines beyond the traditional april 15th.

831 Business Personal Property Tax payment due Assessor-Recorder Payable to. Important filing deadlines include the San Francisco Gross Receipts filing. The Homelessness Gross Receipts Tax is applied to San Francisco taxable gross receipts above 50000000.

Additionally businesses may be subject to up to three city taxes. The filing obligation and tax rates for all. San Francisco pushes back business registration due date.

Residential Landlords with no more than 2000000 in gross receipts in 2021 are exempt from estimated. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. The 2017 gross receipts tax and payroll expense tax return is due.

2022 San Francisco Tax Deadlines

2022 San Francisco Tax Deadlines

Gross Receipts Tax Gr Treasurer Tax Collector

Oregon S Gross Receipts Tax Proposal Would Increase Consumer Prices Tax Foundation

Due Dates For San Francisco Gross Receipts Tax

San Francisco Tax Update Reuben Junius Rose Llp

Sales And Gross Receipts Taxes As Percentage Of Income Source U S Download Scientific Diagram

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

California And Sf Voter Guide For 2022 Election

California State Tax Updates Withum

Monthly Gross Receipts Enter Second Year Growth Government Normantranscript Com

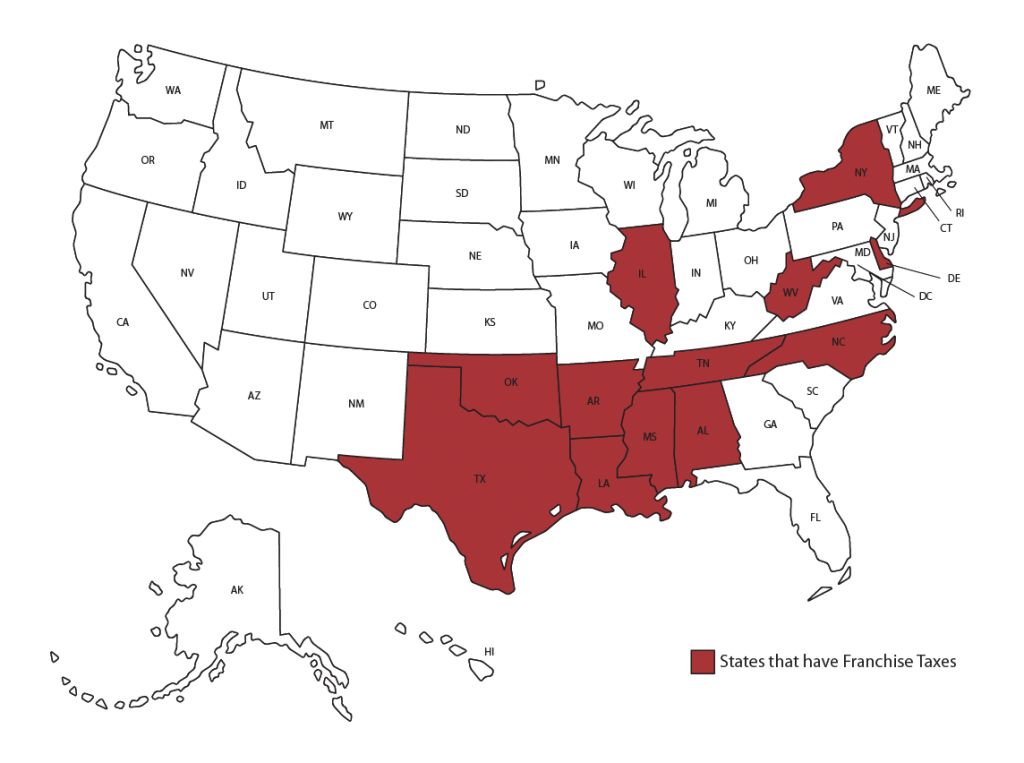

What Is Gross Receipts Tax Overview States With Grt More

Oakland Voters Expected To Decide Business Tax Hike In November Here S What You Need To Know San Francisco Business Times

Office Of Small Business San Francisco

Taxes 2022 7 On Your Side United Way Answer Viewer Questions During Tax Chat Abc7 San Francisco

Gross Receipts Tax And Other Indirect Pmba